Navigating the aftermath of a car accident can be as chaotic as the collision itself. Yet, amidst the havoc, certain steps are critical not only for your safety but also for the smooth handling of insurance claims. Here, we dissect the essentials, distilling my personal ordeal into actionable advice amid broader expert insights.

Learn about common car accidents and how to handle them

- Stop your car immediately after an accident.

- Check for injuries and call 999 if needed.

- Exchange details with the other drivers involved, take photos, and contact your insurance provider.

1. Stop Your Car

The moment after a collision feels surreal. Your first instinct might be to continue driving, especially if the damage appears minimal. I learned the hard way during a minor fender bender last year that this initial reaction can complicate legal and insurance matters immensely. It’s paramount to stop your vehicle as soon as it is safe to do so, regardless of the accident’s severity.

Legally speaking, failing to stop can result in significant penalties or even criminal charges. Heres a practical step-by-step approach:

– Immediately reduce your speed and activate your hazard lights.

– Find a safe spot to pull over, ideally where the accident occurred or close to it, without obstructing traffic.

– Turn off your engine, and wait for the next steps.

2. Check for Injuries

Once your car is secure, check yourself and your passengers for injuries. Remember, adrenaline may mask pain initially. During my first accident, I felt fine initially but later discovered a sprained wrist. When in doubt, its better to err on the side of caution.

- Perform a quick health check on everyone in the vehicle.

- Ask others involved in the accident if they are alright.

- Do not move someone who is seriously injured unless there is a hazard requiring immediate movement.

Insider Tip: Always keep a first aid kit in your car. It can be invaluable in these moments for treating minor injuries while waiting for emergency services.

3. Call 999 if Anyone is Injured or if the Road is Blocked

In the event of injuries or a significant blockage of the road, calling 999 is imperative. This not only ensures that everyone receives necessary medical attention but also that the scene is safely managed by professionals.

- Provide clear details about your location using landmarks or road signs.

- Mention the number of people hurt and the nature of their injuries.

- Follow the operators instructions without hanging up until told to do so.

For further details on what to do in these scenarios, the National Health Service provides comprehensive guidance.

4. Exchange Details with the Other Drivers

This step is crucial for insurance purposes. After my collision, exchanging information was straightforward, but tensions can run high. Keep calm and be polite; anger only complicates the process.

Collect the following:

– Full name and contact information

– Insurance company and policy number

– Drivers license and license plate number

– Type, color, and model of vehicle

– Location of the accident

Documenting these details ensures that your insurance claim or any legal proceedings are based on accurate information.

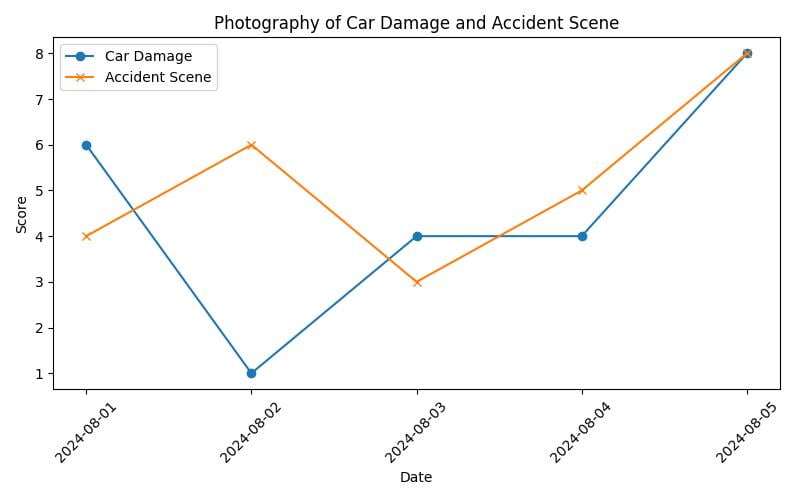

5. Take Photos of the Accident

Visual evidence can significantly enhance the clarity of what occurred. Use your smartphone to take comprehensive photos of:

– All vehicles involved, emphasizing the damage.

– The overall accident scene, including road conditions, traffic signs, and lighting.

– License plates and insurance cards.

These photos can help insurers and legal bodies understand the context and specifics of the incident, facilitating a smoother claim process.

6. Contact Your Insurer

Notifying your insurer should be done as soon as possible after the accident. During my own experience, I found that prompt communication prevented delays and misunderstandings.

- Provide a detailed account of the incident.

- Submit any gathered evidence, including photos and notes.

- Ask about the next steps, such as towing or repair services.

Insider Tip: Understand your policy beforehand; knowing what is covered can alleviate much stress when discussing the accident with your insurer.

By integrating these steps into your post-accident protocol, you equip yourself not only to handle the immediate aftermath but also to navigate the ensuing legal and insurance landscapes effectively.

For more detailed guidance on the nuances of filing an insurance claim, consider visiting our detailed page on how to successfully file an insurance claim.

Real-life Example: Dealing with Insurance Companies

Sarah’s Experience

Sarah was involved in a minor car accident last year. She followed all the necessary steps after the collision, including exchanging details with the other driver and taking photos of the accident scene. However, when it came time to contact her insurance company, she felt overwhelmed and unsure of what information to provide.

How Sarah Dealt with the Situation

Sarah decided to gather all the relevant details about the accident before contacting her insurer. She made notes about the date and time of the incident, the location, and a description of what happened. This preparation not only made the conversation with her insurance company smoother but also ensured that she provided accurate information.

The Lesson Learned

Sarah’s experience taught her the importance of being prepared when dealing with insurance companies after a car accident. By having all the necessary information at hand, she was able to navigate the process more effectively and ensure a quicker resolution to her claim.

Conclusion

The chaos following a car accident is undeniable, but the steps you take immediately after can dictate both your recovery and the ease with which you navigate the aftermath. My journey through a car accident taught me the importance of readiness and informed action. By stopping your car, checking for injuries, contacting emergency services, exchanging details, documenting the scene, and notifying your insurer, you lay a foundation for a controlled and informed resolution to an otherwise turbulent event. Remember, the right actions not only safeguard your health and safety but also protect your legal and financial interests.

Common Questions

Q.What are the common accidents covered by car insurance?

A.Car insurance typically covers accidents like collisions, theft, vandalism, and weather damage.

Q.How can I deal with a car accident covered by insurance?

A.After an accident, notify your insurance company, document the incident, and follow their guidelines for filing a claim.

Q.Who determines if an accident is covered by car insurance?

A.Insurance adjusters assess the accident and the policy to determine coverage eligibility.

Q.What should I do if my insurance denies coverage for an accident?

A.Review your policy details and reasons for denial, and consider appealing the decision or seeking legal advice.

Q.How can I prevent common accidents covered by car insurance?

A.Practice safe driving habits, maintain your vehicle, and follow traffic laws to reduce the risk of accidents.

Q.What happens if I don’t report an accident to my insurance?

A.Failing to report an accident promptly can lead to complications in processing claims, potentially resulting in coverage denial.