Compulsory car insurance is not just another bureaucratic requirement; it’s a fundamental aspect of road safety and financial responsibility. Every time you get behind the wheel, you’re not just operating a vehicleyou’re taking control of a potential catalyst for financial and physical damage. Mandatory car insurance laws are designed to mitigate these risks, ensuring that all parties affected by vehicular accidents have a financial safety net.

Learn about Compulsory Car Insurance

- Importance of compulsory car insurance: It provides financial protection in case of accidents, covers liability, and ensures legal compliance.

- Penalties for non-compliance: Fines, license suspension, vehicle seizure, and potential criminal charges can result from not having compulsory car insurance.

What is Car Insurance?

Car insurance is a contract between you and an insurance company where you pay premiums in exchange for protection against financial losses stemming from an accident or other damage to your vehicle. This agreement is essentialit’s not merely about compliance, but about safeguarding your economic stability and meeting ethical responsibilities toward other road users.

What Does Car Insurance Cover?

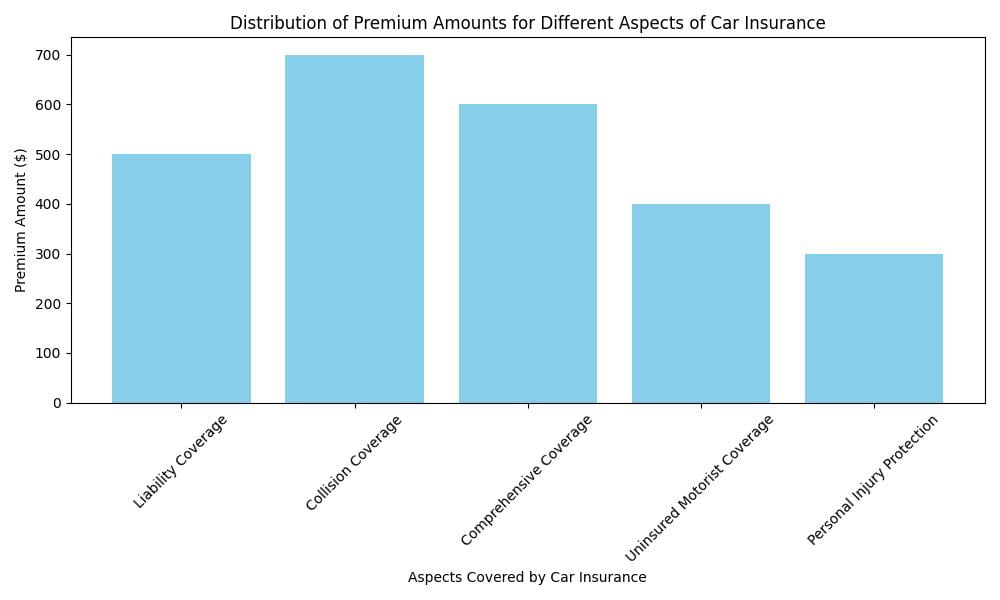

Standard car insurance policies cover a range of potential costs:

– Liability: Costs resulting from bodily injury to others and damage to their property.

– Personal Injury Protection (PIP): Medical payments for the insured driver and passengers.

– Collision: Damage to the insured vehicle from a collision.

– Comprehensive: Damage to the vehicle from non-collision events like theft or weather.

Each component is crucial for comprehensive coverage, protecting assets and ensuring that youre not left financially crippled after an accident.

What are the Different Types of Car Insurance?

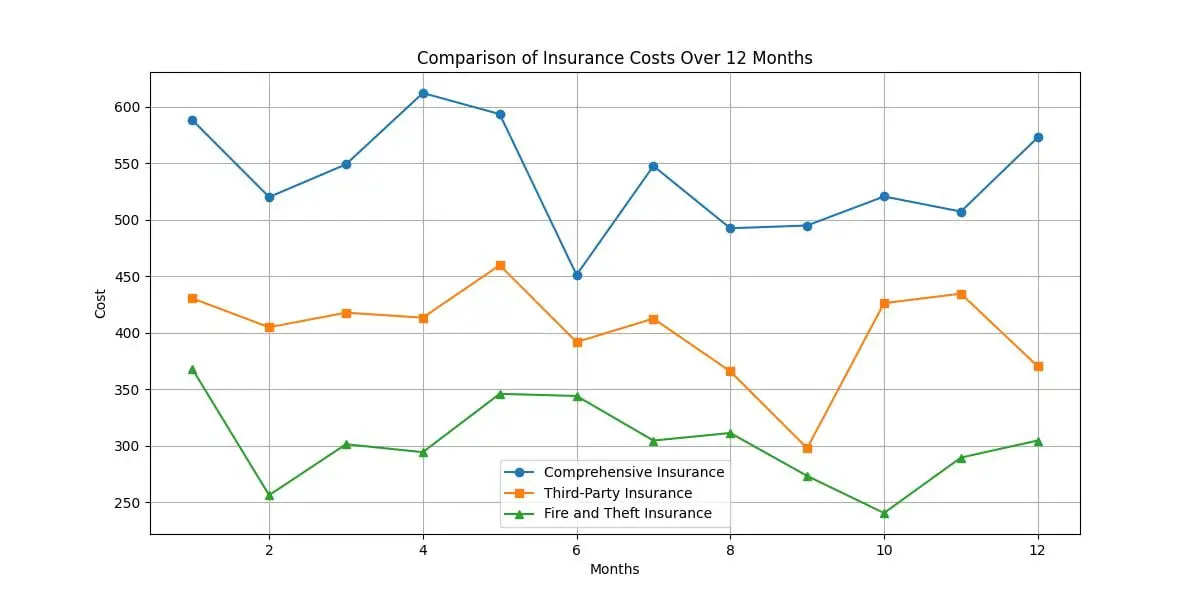

Car insurance varies significantly to accommodate different coverage needs:

– Third-Party: The minimum legal requirement in many countries, covering damages to other people and property, not including the driver.

– Third-Party, Fire and Theft: Covers everything basic third-party policies do, with added protection against fire damage and theft.

– Comprehensive: This includes all the coverages of lesser policies and also protects against damages to the drivers vehicle in accidents, regardless of fault.

Choosing the right type depends on individual needs and the level of risk one is willing to assume.

What is the Minimum Level of Car Insurance Required by Law?

In most jurisdictions, drivers are required to at least have third-party liability insurance. This ensures that if you cause damage or injury to another person or their property, your insurance can cover the costs, up to a certain limit. The specific requirements can vary, so it’s crucial to understand the laws in your area to ensure compliance and adequate coverage.

Insider Tip: Always check local regulations on car insurance minimums to avoid legal penalties and ensure adequate coverage.

What is the Difference Between Comprehensive and Third Party, Fire and Theft Car Insurance?

The main difference lies in the extent of coverage:

– Third Party, Fire and Theft: Covers claims from third parties for injury or damage and also covers your vehicle if stolen or damaged by fire.

– Comprehensive: Covers all of the above plus any damage to your vehicle, even if the accident was your fault, making it the preferred choice for new or expensive cars.

How Can I Save Money on My Car Insurance?

Saving money on car insurance requires a mix of long-term strategies and intelligent choices:

1. Compare Quotes: Use comparison websites like Compare the Market to find the best rates.

2. Increase Your Excess: Opting for a higher voluntary excess can lower premiums.

3. No-Claims Bonus: Protect this bonus as it significantly reduces the cost over time.

Insider Tip: Consider telematics insurance if you’re a safe, low-mileage driver. It bases premiums on actual driving behavior rather than generalized statistics.

How Can I Find the Best Car Insurance for Me?

Finding the best car insurance involves evaluating your specific needs and comparing offers from multiple insurers. Consider factors like coverage options, deductibles, premiums, and customer service ratings. Tools like online comparison platforms streamline this process, allowing you to view quotes from various insurers side-by-side.

Real-Life Example: Finding the Best Car Insurance

Sarah’s Search for the Best Car Insurance

Sarah, a 28-year-old marketing executive, recently purchased her first car, a sleek red hatchback. Excited to hit the road, she realized she needed to find the best car insurance that suited her needs and budget. After comparing quotes from various insurance providers online, Sarah decided to go with a comprehensive car insurance policy that offered coverage for accidental damage, theft, and third-party liability.

The Outcome

By taking the time to research and compare different car insurance options, Sarah was able to find a policy that not only provided her with the coverage she needed but also fit within her budget. She felt confident knowing that she was adequately protected while driving her new car on the busy city streets.

How Do I Make a Claim on My Car Insurance?

To make a claim, notify your insurer as soon as possible after an accident. Provide all necessary documentation, such as police reports, witness statements, and photos of the scene. Be honest and thorough in your report to avoid delays.

How Do I Cancel My Car Insurance Policy?

Cancelling a car insurance policy generally involves notifying your insurer in writing and specifying the date of cancellation. Be aware of potential cancellation fees and ensure you have new coverage in place if you plan to continue driving.

Can I Drive Someone Elses Car on My Car Insurance?

This depends on your policy. Some comprehensive policies include driving other cars (DOC) cover as standard, but this is typically only for emergency use and with the car owner’s permission. Check your policy details to be sure.

Can I Drive Abroad on My Car Insurance?

Driving abroad often requires additional coverage. Many policies offer this as an add-on or include limited foreign use cover. Always confirm the specifics before traveling.

Insider Tip: If frequent travel is part of your lifestyle, consider a policy with inclusive international coverage to avoid the hassle of arranging separate policies.

Can I Get Temporary Car Insurance?

Yes, temporary car insurance is available and can be a great option for short-term use, like borrowing a car or renting a vehicle in another country. Policies can last from one day up to a few months.

Can I Get Car Insurance with a Criminal Conviction?

Obtaining car insurance with a criminal conviction can be challenging but not impossible. Some insurers specialize in high-risk profiles, although premiums may be higher.

Can I Get Car Insurance with a Medical Condition?

Yes, but you must disclose all relevant medical conditions when applying for insurance. Failure to do so can invalidate your policy. Some conditions might increase premiums, while others may not have any impact.

Can I Get Car Insurance if Im Not a UK Resident?

Non-residents can obtain car insurance, but the process and availability can vary. Some insurers might require that you have a valid UK driving license or an International Driving Permit.

In conclusion, compulsory car insurance serves as a critical protective layer, not just for individual drivers but for the public at large. It ensures that anyone affected by vehicular mishaps has recourse to financial compensation, making it an indispensable component of responsible driving. By understanding the nuances of different insurance types and compliance requirements, drivers can make informed choices that align with their needs and legal obligations, thus fostering a safer driving environment for everyone.

Questions & Answers

What is compulsory car insurance?

Compulsory car insurance is a legal requirement for all drivers to have coverage.

Why is compulsory car insurance important?

It ensures that drivers are financially responsible in case of accidents.

How are penalties for not having car insurance enforced?

Penalties can include fines, license suspension, or even vehicle impoundment.

Who mandates compulsory car insurance?

Government authorities regulate and enforce compulsory car insurance laws.

What if I can’t afford car insurance?

There are options for low-income individuals to access affordable insurance plans.

How can I lower my car insurance premiums?

You can lower premiums by maintaining a clean driving record and shopping around for the best rates.